Global Markets Watch: 11 Post-Pandemic Ecommerce Markets to Track

In previous years’ iterations of this post, we’ve pointed to data showing an evenly-paced growth trajectory.

But things have changed. Global markets are no longer focused on planning for ecommerce growth – now they’re doing their best to keep up.

In just one year, ecommerce has grown to where we expected it to be five to seven years from now and several global markets have emerged as leaders.

What Happened to Measured Growth?

It’s the question everyone is asking. The answer is, quite simply, COVID-19. Consumers who could no longer leave their homes or visit stores had no option but to shop online for an extended period of time. Our 2021 Global Ecommerce Consumer Behavior Analysis revealed that most consumers’ online shopping frequency has increased.

Retail sales numbers may have been rough in 2020, but every global ecommerce market reported double-digit ecommerce growth. Two standouts: Argentina and Singapore had 79% and 71% growth in 2020, respectively.

Many first-time online shoppers flocked to known, enterprise-level brands’ websites, which forced those brands to step up their User Experience (UX), Customer Experience (CX) and fraud prevention game. This ecommerce explosion also birthed countless small business online merchants, who took the opportunity to get on the field and chase success.

Ecommerce merchants (whether they are small business or enterprise-level) who are eyeing international expansion should consider the role these markets are playing in 2021 and beyond.

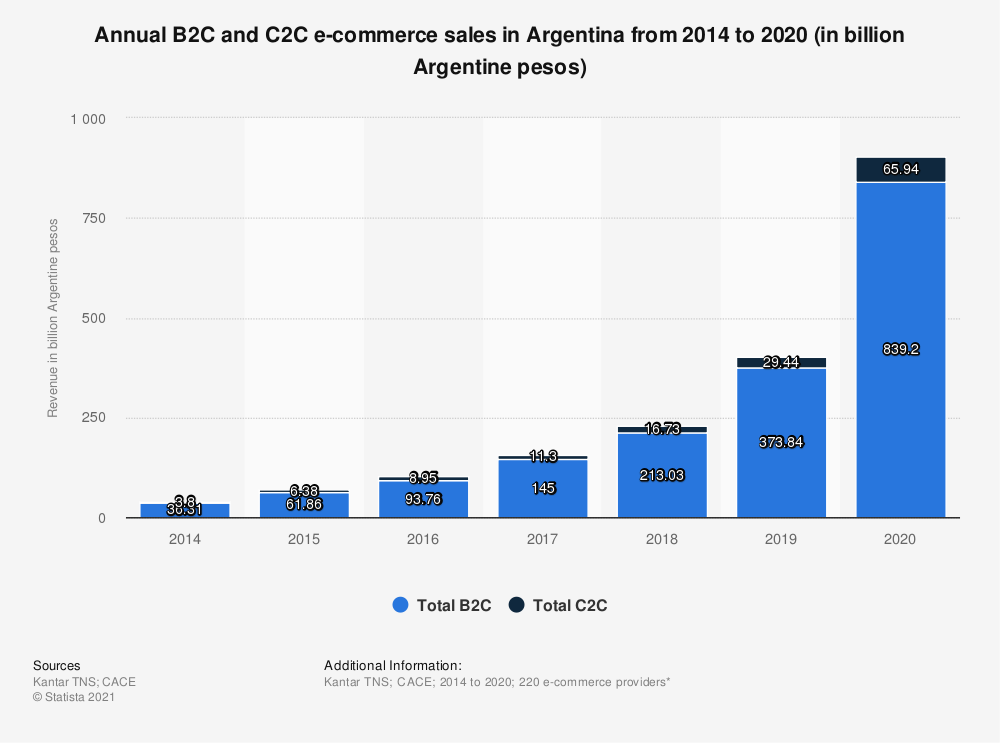

Argentina

Ecommerce in Argentina has exploded in the past year. In addition to its 79% overall ecommerce growth in 2020, Argentina saw a vast increase in the number of online orders – from 89 million in 2019 to 164 million in 2020.

This growth is expected to continue, particularly in mobile commerce: By 2024, m-commerce sales in Argentina are expected to reach $13 billion USD (with desktop ecommerce bringing up the rear at $8 billion USD).

As more and more Argentines embrace ecommerce and m-commerce, they’re leaving cash behind. Adoption of debit cards and digital/mobile wallets is still a bit sluggish, but credit cards are a popular choice.

Merchants looking to set up in Argentina need to focus heavily on delivery options, as Argentine shoppers often struggle with high shipping costs and delivery delays. Prioritizing speedy and reliable delivery will go a long way in impressing these shoppers.

Australia

Australia is the 11th largest ecommerce market in the world, with an annual revenue total of $22.8 billion in 2020. Its consumers are both sophisticated and savvy. They mostly shop online for clothing (51%), followed by media (38%) and consumer electronics (30%).

What’s unique about this market is that the window of opportunity for new merchants may be finite. Ecommerce in Australia grew by more than 10% between 2019 and 2020 and is expected to eventually slow down by 2024. That means ecommerce merchants should take advantage sooner than later.

The good news is Australians are primed for mobile commerce. In fact, they prefer mobile shopping over traditional laptops or desktops. About 73% use mobile devices to purchase and pay for items online, and 33% of online sales are done through mobile devices with an average monthly spend of $235.

Merchants diving into the market Down Under will need to offer a variety of payment options, including credit cards, PayPal, digital wallet, direct transfer and even cash on demand.

Canada

Canada has had slower ecommerce growth before the pandemic, but that seems to be changing quickly. Canadian consumers made more online purchases in 2020, and that trend continues. Ecommerce sales growth is expected to hit double digits by 2023.

In addition to competing with the juggernaut of Amazon’s Canadian site, online merchants looking to succeed in Canada will need to contend with the delivery issue: The pandemic slowed delivery services in the country enough that it has become a hot button for retailers.

Another consideration is choosing the right payment processors. Digital wallets and strong mobile interfaces in both English and French will be important.

China

According to McKinsey & Company, China is “set to retain its preeminent role as the engine of global consumption growth post-pandemic.” Retail ecommerce sales reached nearly $2.3 trillion in 2020 and are projected to surpass $3.5 trillion by 2024.

What this means for ecommerce in China is a mixed bag. Ecommerce platforms, Alibaba and Tencent have seized the opportunity to reach even more consumers since the pandemic started. However, the Chinese digital marketing landscape has become extremely fragmented, making it essential for online merchants to create highly strategic campaigns before entering the market.

Areas of opportunity for ecommerce merchants targeting China include:

- Expansion from B2C to B2B: Digital B2B platforms are leveraging the B2C infrastructure to connect suppliers with retailers, specifically in the grocery and hospitality industries.

- Revenue growth management: This tactic is just being adopted in China to help merchants use granular analytics to determine pricing, promotions, product mix and innovation.

Germany

The third largest ecommerce market in Europe, Germany has tremendous potential – assuming that consumers become more confident in spending post-pandemic.

That said, there is opportunity. In a COVID-19 Germany Consumer Pulse Survey, German consumers indicated they planned to spend more post-pandemic. Over 91% said they will continue to shop online and 44% indicated they will splurge a bit. Household items for home renovations seem to be among the most popular anticipated purchases.

Germany’s mobile penetration at 70% makes mobile and social commerce viable opportunities as well. Merchants should make sure to combat German consumers’ tendency to return products more than consumers in any other country in Europe by offering strong product descriptions and excellent customer service.

Japan

Japan’s ecommerce market is expected to reach $144.08 billion in 2021. This is partly due to the country’s nearly 91% internet penetration. That growth could slow over time, given Japan’s aging population. Of the 126.8 million people in Japan, almost 29% are aged 65 or older.

One interesting factor that benefits Japanese ecommerce merchants and may cause some issue for international merchants is language – communication and culture in Japan are complex and nuanced, making it extremely difficult to create persuasive ecommerce website copy without some serious help from within the country. And don’t assume enough of your customer base will speak English: A Ratuken survey revealed that 70% of adults from Japan feel they are poor at English, and a majority of respondents feel that learning it is unimportant.

For merchants looking to promote cross-border ecommerce into Japan, their websites must be language-enabled. They should also study Japanese websites for their design aesthetic, which is considerably different from websites in the U.S. and Europe.

Mexico

Mexico is a growing market with tremendous opportunity and some considerable risks. Its youthful, smartphone-savvy population makes it a prime market for merchants to sell online. Over 53% of the population shops online.

In 2020, Mexico’s ecommerce revenue surpassed $10 billion and is expected to reach nearly $13 billion by 2024. And the largest product market in Mexico is fashion, which came close to $3 billion in 2020.

One challenge for merchants in the Mexican ecommerce market is payments. About 9% of ecommerce purchases are paid in cash. Consumers make their purchases and pay though vouchers at convenience stores, but debit cards are the preferred payment method at 84%.

Russia

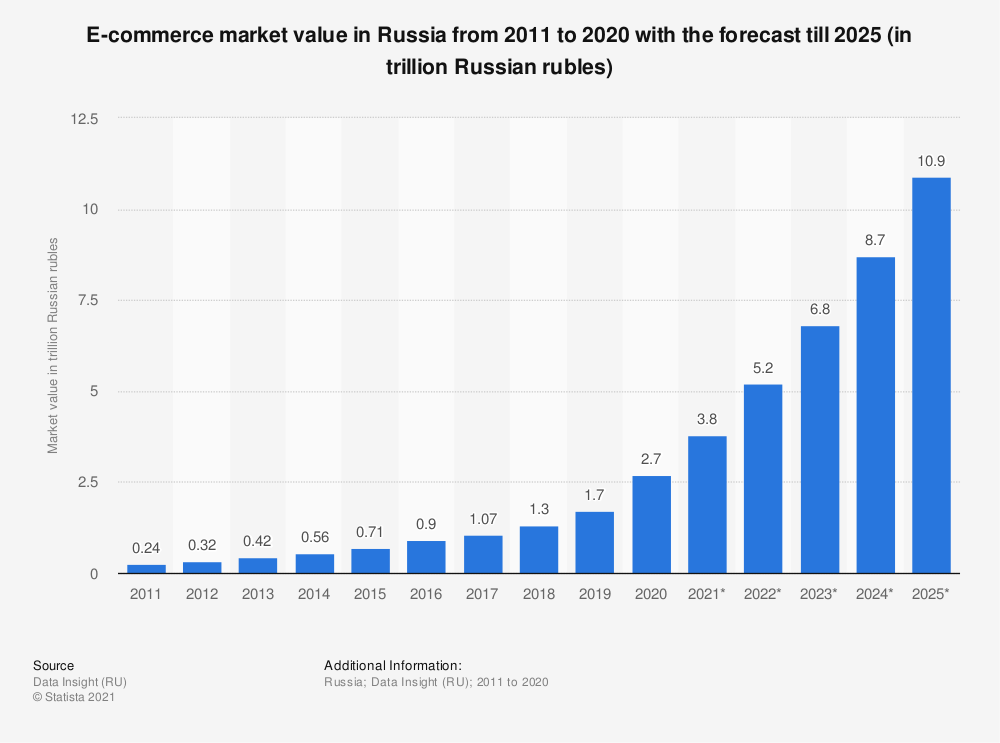

The Russian ecommerce market had already been picking up speed when the pandemic hit—since then, its growth has been stratospheric. From 2019 to 2021 Russia’s ecommerce market value has more than doubled from 1.7 trillion rubles to 3.8 trillion and is projected to reach an impressive 10.9 Trillion rubles by 2025. This makes Russia the fastest growing ecommerce market in the world.

A recent move to cashless payments and online banking, with cashless payments accounting for more than 50% of spending, will no doubt accelerate this growth even further.

Despite this growth, foreign ecommerce merchants have their work cut out for them. Right now, Russians do the overwhelming majority of shopping within their own borders, having little interest in cross-border shopping.

Singapore

Like Japan, Singapore has a high internet penetration and digitally-savvy consumers. It also boasts the highest GDP per capita in the world. The average spend among Singapore’s online consumers is a little over $1,600 – one of the highest in the world.

Industries seeing fast growth in Singapore include personal care, consumer electronics and online food delivery.

These factors, combined with the country’s robust digital infrastructure and early adoption of mobile and social commerce, makes this market ripe for opportunity.

United Kingdom

Ecommerce accounts for more than 25% of all retail sales in the UK, which is expected to increase to one-third by 2024. In 2021, U.K.’s total ecommerce sales are expected to bring in £80,678 million.

What we’ve learned about UK consumers is they are divided by age group:

- Consumers over 55 are more likely to purchase home goods, books and travel online.

- Consumers under 55 gravitate toward beauty supplies, fashion, pet supplies and sporting goods.

- 41% of consumers under 55 are more likely to buy from overseas ecommerce merchants.

- Only 29% of consumers over 55 shop on international ecommerce sites.

- Mobile devices are more widely used among consumers under 55.

Ecommerce consumers in the UK use PayPal most often to purchase items, followed by credit cards.

One hurdle for ecommerce merchants to tackle with UK consumers is trust in the medium itself. They generally view online shopping as less safe than in-store shopping – however, 74% said they would shop online if they knew the merchant had fraud protection.

United States

The United States ecommerce market continues to deliver. The market is forecast to reach over $843 billion in 2021 and nearly $600 billion by 2024.

In particular, luxury goods and fashion ecommerce sales are projected to grow by almost 19% with health care, beauty and personal care growing by 16%. One of the top categories in online retails sales for 2021 will be consumer electronics.

Mobile, voice and social commerce, together with traditional ecommerce are growing in use and creating the need for ecommerce merchants to have an omnichannel strategy to sell in the U.S. Add to that the high expectations for customer service, superior online customer experience, and usability.

Merchants who want to succeed in the U.S. market need to pull out all of the stops – from a full range of payment options to chatbots for 24/7 customer service.

Global Fraud Protection

So, when considering a cross-border expansion, what should merchants be concerned about regarding fraud protection?

It depends on the type of merchant.

Enterprise Merchants Need a Multi-Faceted Approach to Fraud

Enterprise merchants need to be wary when contemplating markets with unusually high transaction amounts, like Singapore. A single purchase could look like fraud to fraud filters, but it may very well be legitimate. A strategic approach to fraud prevention should include both AI-enabled analytics and manual review to ensure the highest approval rates and the fewest number of false declines.

Our studies on consumer behavior have shown that a false decline can not only turn customers away, it can also inspire them to complain on social media. In this connected world, where consumers around the world are connected through their smartphones and social media apps, a bad review can be bad news for a merchant trying to break into a new market.

[Related Reading CTA: https://blog.clear.sale/understanding-the-true-cost-of-false-declines]

Small Business Merchants Need to Watch for Chargebacks

For small business merchants venturing into certain countries, CNP fraud and subsequent chargebacks can become a serious issue (Mexico and Germany from our list have some of the highest chargeback rates in the world, according to Midigator).

Once a merchant’s chargeback rate is too high, they may encounter penalties and fees that make it nearly impossible to break even – especially if a credit card company decides to no longer do business with the merchant.

An fraud prevention solution provider with international experience and knowledge of current fraud trends can help prevent fraud from eating away at revenues.

ClearSale offers solutions that are used by online merchants around the world, giving us a unique view of the industry and a massive database of transactions that can be used to detect fraudulent patterns long before any single merchant could identify them happening to their online store. For assistance in protecting your global ecommerce business, reach out to us for more information.

Sarah Elizabeth

Sarah Elizabeth