The Importance of Business Valuations in the Current Ecommerce Market

The ecommerce market is currently booming. Digital Commerce 360 estimates that US ecommerce sales accounted for about 21% of total US retail sales in 2020, as consumers' behavior shifted away from frequenting brick and mortar stores and moved to purchasing more online. Consumers spent a whopping $861.12 billion online; that’s up 44% year-over-year. This increase is partly due to the pandemic, as most people spent an extra hour online in 2020. It's worth noting that ecommerce growth is not projected to slow down anytime soon. Global sales are expected to increase nearly 14% this year alone. What does this mean for you as an ecommerce seller? Interest in acquiring ecommerce businesses is at a record high and because of this, valuation multiples for ecommerce businesses are also the highest they have been.

If you are wondering who is buying these ecommerce businesses, the answer is many different types of investors including private equity firms, aggregators (roll-up companies), strategic businesses in your market, individuals and public companies that sell similar or adjacent products on a different scale.

Why find out what your ecommerce business is worth?

It is worthwhile to have an understanding of the value of your ecommerce, regardless of if you are contemplating divesting now or down the road. Having this information will be beneficial when it comes time to make strategic decisions about scaling your business. Later in this article, we will outline some key steps you can take to increase the value of your ecommerce business. Regardless of what your long term goals are, it is never a bad idea to take steps that will increase your business’s value.

Key factors that contribute to your business valuation

Arriving at the valuation of your business is not as simple as "If you have $X in revenue, then your business is worth $X." There are many components that play a role in determining the appropriate valuation multiple. When all is said and done, this multiple helps inform the answer to the question: What is your business worth?

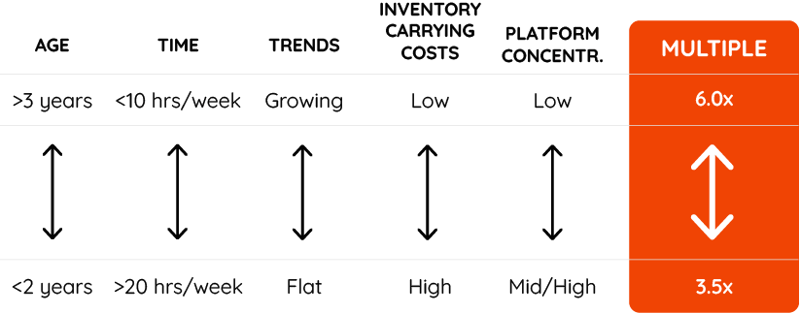

The factors that contribute to a business's valuation multiple include a vast array of financial and operational attributes that impact the business’s transferability, sustainability and scalability. All operational or market factors that impact these core drivers, whether directly or indirectly, will influence the multiple. The factors include the overall financial picture, the age of the business, the time spent managing the business, trends, inventory carrying costs and concentration.

Of course, the financial health of the business will have a strong correlation to its worth. What does the financial picture of your business look like? Are earnings stable? Have gross and net incomes been trending? Are there any anomalies in your business's financial history? This is just a sampling of the questions you will want to consider related to your business's financials.

The age of the business is a critical element in determining a business's valuation multiple. Those that have been in business for a significant amount of time are seen as less of a risk than are younger businesses. Many investors will be interested in seeing a business that has been operating for a minimum of three years, as this timeframe enables the prospective buyer to have a substantial history to look at. We've seen that businesses that have grown steadily over five years or longer end up receiving premium multiples.

What valuation multiples are common for ecommerce businesses?

General valuation drivers (including the ones listed above) are a key consideration, however, it is critical to point out that every business is unique and each business's valuation is arrived at by assessing its one-of-a-kind features. The subtleties of the ecommerce business model mean that several ecommerce-specific factors impact the multiple within the range described below.

In most instances, you will find that the majority of ecommerce businesses are worth somewhere between 3.5x – 6.0x the business’s annual profit (SDE). The SDE is often calculated by looking at the last year's earnings.

3.5x – 6.0x is quite an extensive range. If your business makes $100K in profit per year, that’s a potential valuation range of $350K – $600K, which is no small sum of money. To determine where your business falls within that range, you will examine the factors described above.

How to determine what your ecommerce business is worth

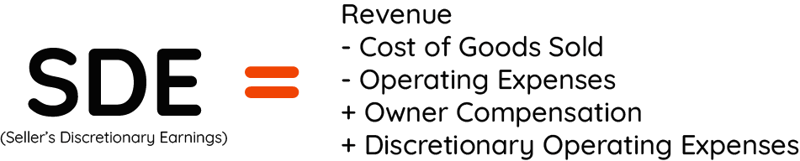

As we mentioned earlier in this article, to arrive at an accurate valuation of an ecommerce business, you need to look at its financial picture, consider other attributes that contribute to its valuation and then determine the appropriate multiple. For most ecommerce businesses, the Seller’s Discretionary Earnings (SDE) method is almost exclusively used to determine earnings or “net income.” SDE is sometimes referred to as "seller discretionary cash flow". It is worth noting that for businesses with more than $50 million in revenue, the Earnings Before Interest, Taxation, Depreciation and Amortization (EBITDA) formula should be used.

How do you arrive at a business' SDE? SDE is the profit left to the business owner once all costs of goods sold and critical (non-discretionary) operating expenses have been deducted from gross revenue. At this point, any owner compensation can also be added back to the profit number since this is a discretionary expense that a new owner could elect to reduce or eliminate. Adding owner compensation back into revenue helps uncover the true earnings power of the business.

When speaking with ecommerce business owners, I often describe SDE using the following formula:

You will want to calculate your business' SDE and then determine a multiple to apply to it. Don't fret, you don't have to go it alone. There are experts to help.

How to increase the value of your ecommerce business

Once you have a sense of what your ecommerce business is worth, you can take steps to raise your business's value. There are many ways to go about achieving your goals in this area. For the purposes of this article, we will highlight a selection of effective methods.

Potential investors will be interested in looking at your business's overall financial picture. If you currently are not optimizing your return on ad spend, ramping up or refining your advertising efforts may be a worthwhile endeavor. Ad campaigns that consistently generate a profit will help make your business more attractive to buyers and will also increase the value of your ecommerce business.

Your business's ranking and proportion of positive reviews can influence its valuation. By ensuring that your customers have a best-in-class experience, the effort you put in will be reflected in your customer reviews. Having an abundance of positive reviews can increase what your business is worth.

Having strong relationships with suppliers is key to your business's success. Increasing partnerships with a diverse range of suppliers, particularly exclusive partnerships, can help increase the value of your business. We've seen that businesses with greater diversification have greater success than those with a narrow focus. Offering a wide range of products from multiple suppliers means that a sudden drop in demand for a product or a dissolution of a supplier relationship will not result in deep ramifications for your business.

Another area that can add value to your business is making improvements in the logistics and fulfillment space. Many ecommerce merchants may start off handling their own shipping and fulfillment, however, as their businesses grow, this may not be feasible or cost-effective in the long run. Outsourcing this function may enable your business to grow at a faster rate, thereby helping to increase the value of your business.

Customer returns, refunds and chargebacks are a fact of life for nearly all ecommerce businesses. It is worth noting that in many cases, improvements in these areas can result in improved business valuations. If chargebacks are very high, this may indicate that the business does not have sufficient fraud prevention measures in place. Taking steps to reduce returns, refunds and chargebacks can positively impact a business's bottom line, which will also positively impact the business's valuation.

What is your ecommerce business worth?

The ecommerce sector is thriving with no signs of slowing down anytime soon. As consumer behavior has shifted to favor online shopping, the ecommerce business acquisition landscape is rife with opportunity and puts ecommerce business owners in a position of strength. When determining the next steps for you and your business it is helpful to have a sense of what your business is worth. At FE International, we have advised on the valuation and sale of profitable online stores for more than a decade. We have found that ecommerce businesses are generally worth somewhere between 3.5x – 6.0x the business’s annual profit (SDE).

In this article we have outlined why it is worthwhile to find out what your ecommerce business is worth, the key factors that contribute to ecommerce valuation, what to expect when it comes to ecommerce business valuation ranges, how to determine what your ecommerce business is worth and how to increase your business' valuation. Regardless of your plans for your business, we recommend that you have a sense of what your ecommerce business is worth by getting a free valuation.

Thomas Smale, CEO of FE International

Thomas Smale, CEO of FE International