LATAM Ecommerce: What You Need to Know

Latin American (LATAM) ecommerce is dynamic and growing — presenting excellent opportunities for businesses that don’t mind doing their homework … and maybe taking a bit of extra risk. While LATAM as a whole still lags a bit behind other regions when it comes to ecommerce adoption and maturity, a closer look reveals some thriving regional ecommerce markets … with other regions on the brink of big things.

As with many other regions, ecommerce in Latin America grew significantly in 2020 as people had no choice but to stay home. This rate of growth was interrupted in 2022 when global economic shakiness put a damper on discretionary spending. But things are already looking up. The LATAM region is predicted to rally, with its market of 300 million digital buyers expected to grow over 20% by 2027, and Morgan Stanley predicting ecommerce sales in LATAM to account for almost 20% of total retail sales by the year 2026.

However, the numbers tell only part of the tale. For example, the LATAM payment ecosystem is wildly varied, which makes payments complicated and getting customers to trust you with their payment information even more challenging.

To help LATAM ecommerce retailers succeed and anticipate challenges, we need to take a closer look at specific countries within the region.

LATAM Ecommerce Maturity: A Study in Contrasts

Consumers across the LATAM region are increasingly enjoying shopping online. What that looks like, however, depends entirely on the country they’re shopping in. Ecommerce markets in the LATAM region range wildly from barely nascent to very mature. While far from an exhaustive list, this cross-sampling of LATAM ecommerce markets should illustrate the absolute necessity of doing your research and preparing to be flexible.

Argentina was in the right place, right time for ecommerce success

Argentina’s ecommerce market skyrocketed during the pandemic — from 7.6% in 2019 to 37% after just one month of pandemic lockdown. And this new habit stuck, with ecommerce in the country growing 68% in 2021. By the end of 2022, Argentina was sixth out of the top 10 countries for retail ecommerce sales growth, and second in LATAM (just behind Brazil).

It helps that the stage was set for ecommerce success: 90% of Argentina’s population uses the internet, and an equal percentage of the populace has mobile phones. This is also likely why mobile commerce in Argentina is anticipated to be a big winner, with the mobile commerce market size expected to jump from US$11.4 billion in 2022 to US$27.1 billion in 2026 – a faster pace of growth than in any other LATAM market (including Mexico and Brazil!).

Ecommerce in Chile is growing by leaps and bounds

As with many other countries, 2020 was a banner year for ecommerce in Chile, reaching sales of US$9.4 billion. One of the biggest retailers in Chile, Mercado Libre, saw a 200% increase in sales in 2020. Since then, Chilean ecommerce has only continued to grow, with an estimated US$12.6 billion in sales in 2022 — doubling 2019’s sales figures, and fifth in LATAM for ecommerce market share. Digital sales are forecasted to increase by 25% in 2023, reaching a new high of about US$15.7 billion.

Peru is an emerging market to watch

Peru had a bit of a slower start to ecommerce but is catching up at lightning speed. In 2019, only 1% of Peruvians shopped online. The country went from cash-in-store only to a 28% in ecommerce growth almost overnight. By the end of 2021, Peruvian ecommerce consumers accounted for 43% of the population, contributing to a sharp growth curve in B2C ecommerce revenue: from US$2.3 billion in 2015 to US$9.3 billion in 2021.

Ecommerce businesses looking to set up shop in Peru will need to know that this market is particularly fond of doing their online homework before making a purchase — comprehensive product information and reviews will be key to earning their trust. Additionally, m-commerce will be key in this region, with Peruvians relying on mobile devices over desktops to complete a purchase almost three-quarters of the time.

Brazil is the LATAM ecommerce leader

Owning 29.5% of the LATAM/Caribbean ecommerce market, Brazil is an unstoppable juggernaut. The retail ecommerce revenue in this market leapt from US$23.3 billion in 2019 to US$30.5 billion the following year. One of many great years. Since then, this market has continued to explode and is projected to reach US$47.6 billion by the end of 2023 … and a whopping US$82.3 billion by 2027.

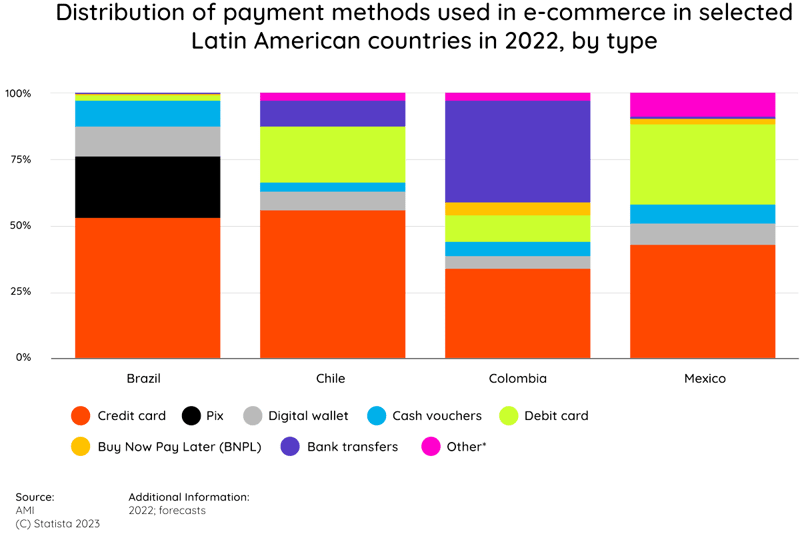

But, fraud has always been a thorn in Brazil’s side, with 49% of citizens having experienced card fraud between 2011 and 2016 (compared with a global average of 30%). As a result, credit card adoption has been slower than in other regions; only 50% of shoppers prefer to use them.

Colombia has come into its own

Just a few years ago, the ecommerce market in Colombia was one to watch, with growth tracking at about 20% every year, and not quite 22 million Colombians shopping online. In short order, the market has matured into its current form, with over 26 million online buyers … and triple the number of online transactions. Today, the Colombian ecommerce market is catching up to giants like Brazil, driven largely by consumers who are looking for conveniences like an easy checkout process and free delivery.

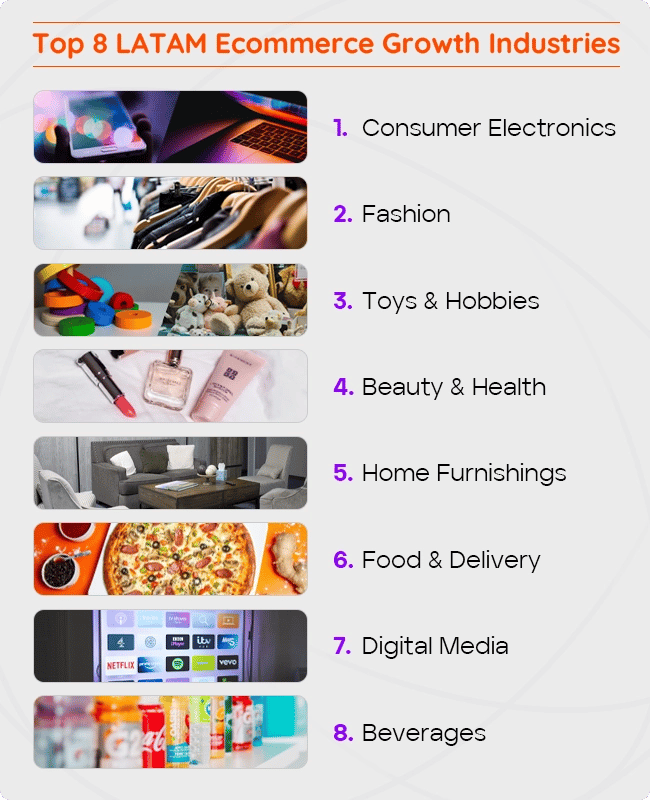

What LATAM Ecommerce Customers Buy

For many years now, electronics has held the most popular spot on LATAM ecommerce customers’ lists. Multiple verticals have seen significant growth, and they’ll continue to do so. Keep an eye on food, in particular: It’s projected to reach 10X growth by 2027.

Challenges in the LATAM Market

Any ecommerce business looking to enter the LATAM market has to consider payments. In particular, the various banking systems. A lack of bank density in many countries means getting to a physical bank remains an insurmountable challenge for LATAM consumers. This has contributed to wildly divergent rates of bank account penetration across the region. For instance, only 21% of Brazil was unbanked as of 2020, compared to 42% of Bolivians and 64% of El Salvadorians.

This lack of consistent financial infrastructure has resulted in a multitude of payment options springing up, with LATAM customers relying on everything from credit cards to bank transfers to cash on delivery and more.

Tax complications

The value-added tax (VAT) in Latin America is a significant source of each country’s tax revenue and ranges anywhere from 10% up to 22% — with differing layers of complexity for each country. Brazil, as an example, has federal and state VATs that apply, along with a few other types of taxes. Other countries have a flat VAT rate across the board, further underscoring the need for due diligence.

Difficult logistics

The state of “last-mile logistics” (getting the item to the customer’s doorstep) has long been a point of contention in the LATAM region. Dreams of quick delivery have long been crushed by the region’s terrain, traffic and still-developing ecommerce logistics infrastructure. However, startups are eyeing that gap and turning to innovative ways to fill it, offering exciting opportunities for ecommerce businesses in the region.

Looking for country-specific challenges? Here are several to consider.

Country-specific ecommerce considerations

Argentinian consumers who engage in cross-border ecommerce are subject to two regulated consumer import frameworks: “door to door” and “small package.”

Uruguayans are ahead of some Latin American neighbors when it comes to local and international credit card usage — accounting for 70% of transactions – but about 20% of purchases are still cash-based.

Ecuador is similar, with a little over half of consumers having a bank account and nearly a third using debit cards. However, 48% of Ecuadorian ecommerce consumers used credit cards in 2021.

Chileans have a high mobile penetration and 73% of banked customers in Chile create a natural market for the expansion of digital payments. The Chilean government is taking an active role in supporting ecommerce security measures, making it a country to watch.

Rampant fraud and false declines

Payment fraud is a global phenomenon, and LATAM is no exception. Latin America has the highest credit card fraud rate in the world — 97% higher than North America’s rate and 222% higher than that of the Asia-Pacific region.

Fraud in LATAM is so pervasive, in fact, that most online businesses resort to extreme measures and automatically decline any order that even looks like fraud. They do this using automated systems that auto-decline suspicious transactions and/or fraud filters that are often too strict.

While this may help reduce chargebacks, it creates an even bigger problem that plagues LATAM ecommerce businesses: false declines.

The high cost of false declines

False declines happen when a company mistakes a valid customer for a fraudster and declines the transaction. Javelin reports that 58% of declined transactions are actually legitimate orders. Our original research shows that 41% of all consumers will never shop with a retailer again after a false decline and 32% will complain about that retailer on social media.

It’s no wonder that the cost per $1 in false declines is a whopping $13. Even more concerning is the fact that the vast majority of declined transactions are valid customers. Throughout LATAM, the false declines rate is holding at right around 50% — that’s a lot of money left on the table.

Ecommerce retailers must have a strategy to prevent fraud, chargebacks and false declines if they want to succeed anywhere in the LATAM region.

How ClearSale Helps LATAM Retailers Protect Their Bottom Line

At ClearSale, we have developed a global lens and large database that allows us to help clients approve more orders, faster.

Our insight into fraud patterns and trends comes from working with businesses around the world in some of the most high-risk regions. We maintain a massive transaction database that is constantly learning as more orders are processed, and we can see the impact fraud has on diverse markets. This makes it easier for us to identify fraud trends as soon as they emerge and then use those insights to make more accurate decisions.

Machine learning/AI

All transactions are screened using artificial intelligence and machine learning to process transactions and fine-tune fraud models based on customer behavior. Transactions that pass with flying colors are automatically approved, and questionable or suspicious transactions are flagged for further review.

Contextual fraud review

Our data scientists and fraud analysts can help with secondary reviews of potentially fraudulent orders. They use their expertise and understanding of fraud trends – while sharing that information with your team – to determine if a transaction is valid or not. And, if a company so chooses, our analysts can pleasantly and very diplomatically reach out directly to customers to confirm they made the purchase —all the while, training your team to do the same.

Post-processing audit

Machine learning/AI can also be used post-processing to validate decisions and help find patterns to be aware of moving forward. For instance, our auditing program offers a safe test environment where we analyze random sets of declined transactions to see what would have happened if we had approved the orders. This enables us to measure the accuracy of our client’s automated rules and fine-tune them as needed.

If you’re thinking about expanding the reach of your ecommerce business into the LATAM market, get in touch with us today to talk about keeping your business, your reputation and your customers safe from fraud.

Victor Islas

Victor Islas

![[Related Reading] Best practices in fraud prevention and CX for cross-border trade](https://no-cache.hubspot.com/cta/default/2530812/3ac1dbb8-c058-4fe2-b000-34bf55eb3cac.png)