Choosing the Right Fraud Prevention Tool

For online store owners, the booming growth in ecommerce comes with an unfortunate downside: ecommerce fraud is booming too. Juniper Research reports that worldwide ecommerce fraud is expected to reach US$206 billion by 2025, and businesses have the potential to lose more than US$343 billion to online fraud through 2027. What makes ecommerce fraud so tricky to combat is the skill and ingenuity of the fraudsters. For every improvement in defense against online criminal activity, online crooks up their game. To protect your business, your profits and your reputation, you need a fraud prevention tool to stay one step ahead of the fraudsters.

Finding a Fool-Proof Fraud Prevention Tool Can Be Tough

Ideally, a fraud prevention tool will detect suspicious activity, reduce financial losses and maintain customer trust. One of the most widely used tools is the fraud filter because it frequently comes built-in to an ecommerce platform and is designed to identify potentially fraudulent orders and prevent them from being processed.

Such filters look for triggers like billing and shipping addresses that don’t match, errors in the CVV number, larger-than-usual orders or purchases during high-risk periods like holidays.

However, broad filters like these can also catch legitimate shoppers in their net. Fraud filters don’t have the artificial intelligence to “learn” behavior. A transaction that looks fraudulent is assumed to be fraudulent, whether it is or is not. These false declines cost a business in multiple ways:

- No option for contextual review: If a valid transaction is declined, customers get frustrated, can stop shopping with you and even leave a bad review on social media.

- Few options for customizing: Ecommerce businesses would need to have their developers or a consultant customize standard filters to account for every potential valid customer.

- Potentially lower approval rate: The order in which fraud filter rules are applied can result in rules contradictions, which may reduce the number of approved transactions.

While fraud filters are an important part of a fraud solution, their drawbacks put an ecommerce business’ profitability at risk. A more comprehensive tool is better suited to strike the right balance between fraud prevention and a speedy, trouble-free check-out experience for customers.

How to Recognize a Good Fraud Prevention Tool

What should you look for in a comprehensive fraud prevention tool?

Business protection and growth

Let’s start with outcomes that benefit your business:

- Fast processing: Automatic processing of obviously valid transactions, which adds to the customer experience.

- Fewer false declines and higher approval rates: A combination of AI and contextual review that distinguishes between clearly fraudulent and potentially fraudulent transactions.

- Full transparency: Data analysis that provides the company with information about why a transaction was flagged.

- Fewer chargebacks: AI that “learns” customer behavior and considers fraud trends to quickly spot fraud patterns.

- Iterative algorithm: A solution that takes into account historical customer and transactional data to improve processing accuracy.

A trusted provider

Next, you’ll want a tool that comes from a company with experience, resources and excellent service performance. After all, if you’re going to trust your company’s reputation to a third party, they should have an excellent reputation themselves.

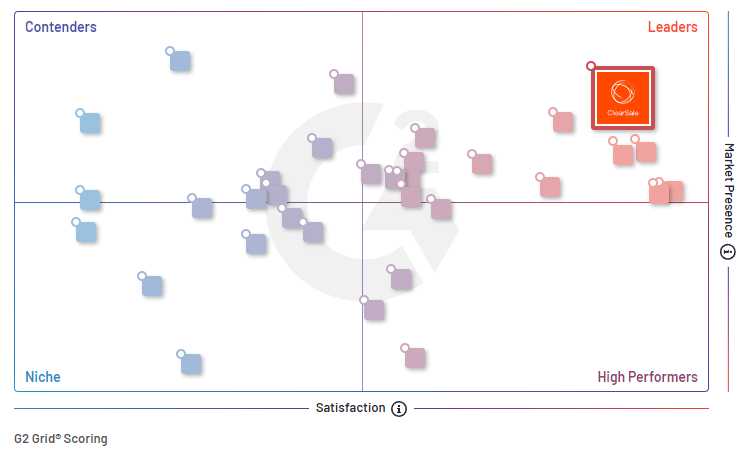

In G2 Grid® Reports, the largest and most trusted software marketplace, ClearSale has been included in both the fraud detection and protection categories for the past three years.

G2 Grid® for E-commerce Fraud Protection Software | Winter 2024

G2 Grid® for E-commerce Fraud Protection Software | Winter 2024

Advanced capabilities

Finally, you’ll want a solution that offers the most advanced and sophisticated technologies and methodologies. Here are some to prioritize:

Real-time analytics

An algorithm that is constantly accounting for trends in real-time to detect and prevent online fraud. For the most part, this activity happens in the background. When a system detects something unusual, it can block the order and route it for contextual review.

Machine learning can continually analyze data generated by online transactions and customer behavior to learn what typical behavior and activity looks like for each client and then detect orders that deviate from those norms.

This combination of monitoring and analytics allows online businesses to effectively prevent fraudulent orders without negatively impacting the customer’s checkout experience.

Understandable order scores for efficient decision-making

A fraud score that uses predictive techniques to capture patterns of fraudulent activity, based on information about a transaction (like IP address, AVS result, shipment method, billing/shipping addresses, and type of email address), differentiate these patterns from legitimate purchasing activity, and turn it into a numeric value that indicates the probability that a transaction may be fraudulent.

For fraud scores to be effective, they need to be created based on the variables that are important to individual industries and businesses and they should be based on the level of threat they pose to a business. These scores can be useful for both machines and human agents in deciding how to act in certain scenarios.

Customizable approval and decline thresholds

Businesses should have the ability to customize thresholds pertaining to order approval and decline to either be more strict or more lenient in search of a “sweet spot” that offers the most overall value from the process. Automatic approvals thresholds should be applied instantly, which is important for businesses in this extremely competitive ecommerce industry. Those companies that take too long to approve orders risk losing customers.

How ClearSale's Fraud Prevention Tool Measures Up

At ClearSale, we understand that our clients are not fraud experts. With our new visual interface, they don’t have to be. Clients can use our dashboard to easily understand and analyze fraud data and efficiently manage transactions and chargebacks. With this tool, businesses can focus on helping their customers, not spend time trying to understand and manage their fraud data.

The dashboard offers the ability to see fraud detection and prevention information from a high level all the way down to individual transactions.

ClearSale’s dashboard features

- View chargeback information, a comparison of total transactions versus approved, and a roll-up of avoided fraud

- Filter by a specific timeframe or store

- Drill down into individual orders to see order details, payments, and even the transaction’s fraud score and specific fraud-related red flags

- See an overview of all chargeback claims, a detailed view of each claim, and relevant documentation and data related to the chargeback

- Ability for business to override transaction denial on individual orders when it is a known customer

- Ability to adjust fraud score thresholds based on needs and trends for the business.

How ClearSale Reduces Chargebacks

Total Chargeback Protection

Businesses can recoup a portion of any losses due to fraudulent transactions. We agree on a Service Level Agreement based on specific KPI thresholds related to fraudulent transactions and chargebacks. Every quarter, we reconcile our fraud and chargeback prevention performance against those KPIs. If we don’t meet the KPI thresholds, you receive a discount on your invoice.

Chargeback Guarantee

Businesses get 100% coverage for any fraud-related chargebacks incurred. If we approve a transaction that turns out to be fraudulent and results in a chargeback, we will pay the entire amount of the chargeback. This gives you the confidence that we are actively reviewing every order to block fraudulent orders and prevent chargebacks. You also gain peace of mind knowing that if a fraudulent order does slip through, your bottom line is still safe.

End-to-End Chargeback Management

This service augments in-house fraud prevention teams to dispute and resolve chargebacks and reduce losses. Through a partnership with ChargebackOps, we leverage the data intelligence and expertise of our fraud and chargeback management analysts to assist your in-house fraud prevention teams at a moment’s notice. We conduct research to aid in chargeback disputes and help companies prevent losing revenue.

All the advanced features in the world won’t protect your ecommerce operation if they don’t work seamlessly with your existing systems. ClearSale offers plugins and guides for major platforms so you can quickly integrate Clearsale's solution in your CMS or ecommerce platform. In fact, clients on major platforms can integrate in just three easy steps.

You won’t have to be tied to your computer for on-the-go fraud protection. Both standard and customizable reports can be accessed online 24/7 via mobile device, or you can schedule automated reports to fit your schedule.

The Right Fraud Prevention Tool Will Maximize ROI

The best fraud protection solution doesn’t just prevent losses, it should also improve profitability. See for yourself how ClearSale’s robust fraud prevention strategy helps clients across industries prevent fraud and chargebacks. To learn more, contact a ClearSale analyst today.

Elma Ocampo

Elma Ocampo